Thursday, October 18, 2018

Otak Sabah diCuri oleh Malaya

Wednesday, October 17, 2018

LHDN disiasat

LHDN disiasat

Friday, April 28, 2017

Penalty for not Submitting Income Tax Return Form

"Every individual in Malaysia, including resident or non-resident who is liable to tax is required to declare his income to Inland Revenue Board of Malaysia (IRBM) or Lembaga Hasil Dalam Negeri Malaysia (LDHN). Taxpayer is responsible to submit Income Tax Return Form (ITRF) and make income tax payment yearly prior to due date."

This is a bad advice. Be careful.

It is better to be extra careful with LHDN of Malaysia.

It does not matter if you are liable to be taxed or not, you still must submit your ITRF.

It happened to me that I was penalised once only, fortunately.

I went to Singapore in 1990 and I had informed LHDN about my change of address.

Suddenly I was slapped with a penalty of RM50 for not submitting ITRF.

I just paid RM50 but submitted an appeal. No reply at all. As usual.

I argued that I do not have any income in Singapore so why should I need to submit ITRF. It is difficult for me to get the forms because in those days we still use manual forms. Of course I can get the forms by hook and crook but it will cost me a lot of time and money for such an unnecessary task which common will tell that I do not need to pay any tax in Malaysia.

What I was angry about was the silence of LHDN in issuing the penalties. Usually penalties can only be imposed if we deliberately do not want to submit ITRF. To prove that, LHDN should send warning letters first. In my case, there was no warning letter at all. That was what frustrated me. Not the penalty or amount that needs to be paid. The lack of warning to me appears as though LHDN deliberately wants us to break the laws so that we can be penalised. It is so unfair.

Tuesday, September 4, 2007

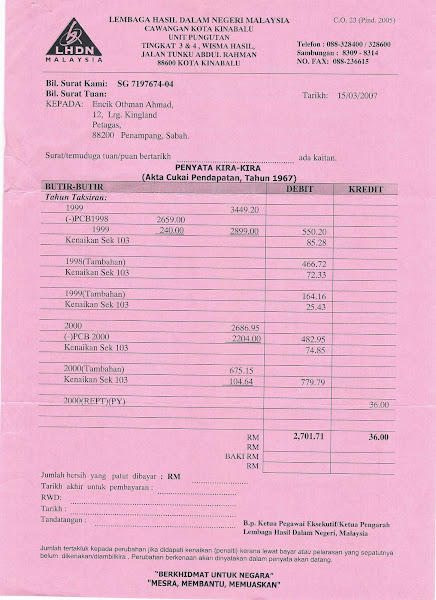

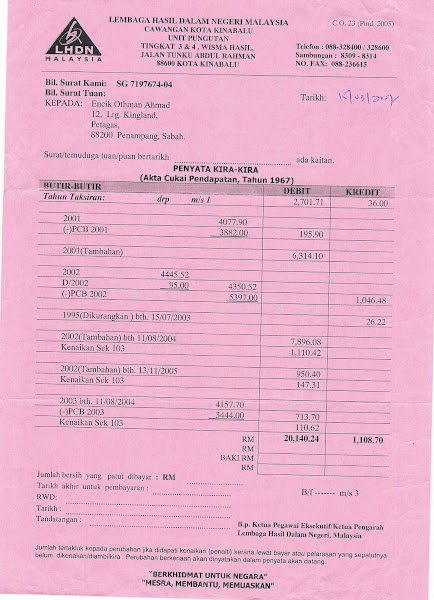

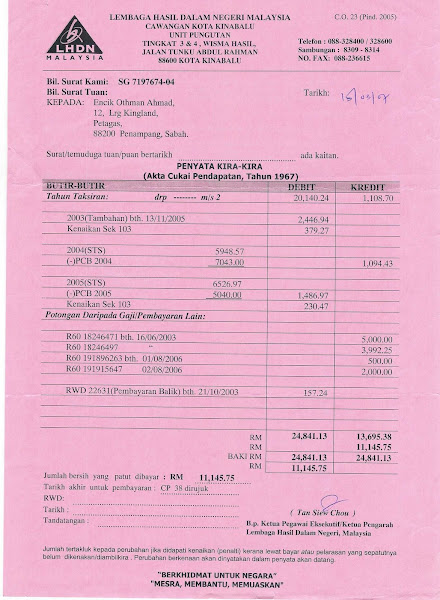

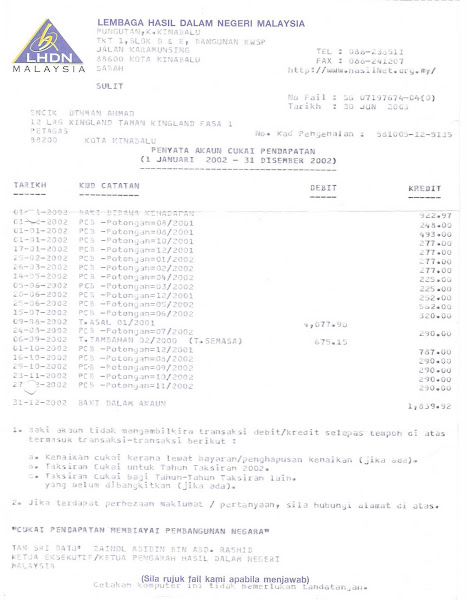

Illegal Actions of the Inland Revenue Board

But tax is only valid after assesment is made so any deduction before this date is illegal.

I didn't have the chance to raise this issue as my case was dismissed without any chance for it to be judged by the magistrate. I'm still waiting for the written judement so that I can take further actions.

I took this action because I was victimised as I was penalised heavily at 120% per year interest without any notice and despite having already paid my taxes. All appeals had fallen to deaf ears.

Already reported to the police and ACA. Waiting for IRD to send my complaints to the Special Commissioners, which they are still delaying after more than a month already.

Defence Against Dismissal of Small Claims against Income Tax Board Employee

IN THE MAGISTRATE COURT AT KOTA KINABALU

IN THE STATE OF SABAH, MALAYSIA

CASE NO: 77-20-2007

(Small Claim Procedure)

BETWEEN

OTHMAN BIN

AHMAD ...

PLAINTIFF

AND

TAN SIEW CHOU ...

DEFENDANT

PEMBELAAN KEPADA TUNTUTAN PEMBATALAN KES

1. The procedure used to request for a dismissal of this case is not

valid because this case is under a separate order 54 with its own separate

procedures for filing of cases and there is no allowance for any dismissal of

any case prior to hearing.

2. The court should also note the intention of the Parliament in

instituting the Small Claims procedures that are already widely used much

earlier in other commonwealth nations, notably Singapore. The judges in Singapore in Small Claims procedures are referred to as a referees only who should listen

to all cases. This court will be a mockery of the world if it were to allow

higher court procedures to override the small claims procedures as written in

order 54.

3. The plaintiff objects to the late submission of this application for

dismissal. Despite having been given the plaintiff's reply to the defendant's

statement of defence, at which time the intention to request for consideration

for dismissal of this case was made, it took the defendant more than three

weeks to submit this application to the plaintiff on the 12th of

June, 2007, just one week before the date of the second hearing. This shows

the malicious intent of the defendant throughout the plaintiff's dealings and

requests for justification for obviously unjust actions. The plaintiff strongly

objects to this short notice and the court should consider this as a ground to

dismiss this application for dismissal for this case which is under the small

claims court. Please take into account that this small claims court procedure

is only for claims less than RM5000. The plaintiff is an ordinary citizen who

has to take care of other matters and have no monetary justification to engage

lawyers to prepare this case. One week is too short for normal citizens, who

are not legally trained, to prepare an answer to legally prepared documents.

Under this circumstance the intention to delay this submission is malicious in

intent.

4. In paragraph 1 of the notice of application for dismissal, the claim

that this case of the small claims procedure discloses no reasonable cause of

action is malicious in intent again. The plaintiff claims that the defendant

has broken the very act that LHDN was formed and governed as well as the

Anti-corruption act. The only defence offered is that the defendant is immune

from any prosecution contrary to the constitution that every citizen is equal

before that law and the acts and previous court cases never allow any civil

servant to act not in good faith.

5. In paragraph 2 of the notice of application for dismissal, whatever

costs that need to be awarded must comply with order 54 under which this case

was filed.

6. In paragraph 1 of the grounds for the application for dismissal, the

acts and court cases does not support the argument that the defendant cannot be

sued for damages if a government employee breaks the law with malicious intent

and not not in good faith. The cases against the police officers who were

prosecuted on their personal capacities for alleged rape of detainees under

their care and authority were recorded in Kota Kinabalu in the case of the

Menggatal Detention centre for illegal immigrants and another court in West Malaysia.

7. In paragraph 2 of the grounds for the application for dismissal, in

section 21 of the Inland Revenue Board of Malaysia Act(Act 533) does not

protect employees who are not acting in good faith(“for anything which is

done in good faith”). The immunity against legal proceedings is conditional on

good faith. The plaintiff's claims that the defendant has falsified documents

and exceeded the authority granted by the acts in imposing penalties for taxes

that had already been paid, had never been addressed by the defendant, and are

certainly not within the performance of her official duties. The plaintiff

finally realised that this is not the fault of the government or Members of

Parliament who passed these laws but the fault of employees who are breaking

the laws that were passed by Parliament.

8. Section 21 of the Inland Revenue Board of Malaysia Act(Act 533) must

be interpreted in full as demonstrated by the judgement “A taxing statute has

to be strictly construed and tax cannot be imposed unless there are clear and

unambiguous words which show an intention to tax a subject: Supreme court

National Land Finance Co-operative Society Ltd. v Director general of Inland

Revenue (1994) 1 MLJ 99”.

9. In paragraph 3 of the grounds for the application for dismissal, is

again malicious in intent. By not considering the section in full, the

defendant has violated the judgement mentioned in the paragraph above. The

phrase “for anything which is done in good faith” is completely ignored. By

ignoring this phrase, it has led to the false belief that the defendant is

completely immune from any prosecution, which had led to the obviously illegal

acts committed against the plaintiff. The plaintiff is therefore entitled to

damages as allowed by law.

10. In paragraph 4 of the grounds for the application for dismissal,

Section 29(1) and (2) of the Inland Revenue Board of Malaysia Act(Act 533)

refers only to the board, not to its employees. This statement of claim is

against the employees of the board that has violated the Income Tax Act as

allowed by Section 118 of the Income Tax Act by acting in bad faith and the

Akta Pencegahan Rasuah 1997, Akta 575. However the Plaintiff reserves the right

to sue any person or organisation as allowed by law. So the argument that the

plaintiff cannot sue the defendant by referring to this section is certainly a

case of misunderstanding of the English language. In fact the sections mentioned

clearly allowed court cases can be taken against the board, but the

organisation that will be named will the the government. This is natural but in

this case, the plaintiff is clearly mentioning a particular employee that

appears to have exceeded her authority as written by statue laws as well as

common law and principles of justice, and therefore the board cannot be faulted

sufficiently for significant damages to be claimed, unless the defendant

releases more evidences.

11. Therefore I urge the court not to be misled by the malicious

quotations of sections of statute acts in fragments and poor understanding of

the English language, and to refer to the plaintiff's previous documents filed

on this case.

Dated this 14th of June, 2007

Counter Defence Against Income Tax Board Employee

IN THE MAGISTRATE COURT AT KOTA KINABALU

IN THE STATE OF SABAH, MALAYSIA

CASE NO: 77-20-2007

(Small Claim Procedure)

BETWEEN

OTHMAN BIN

AHMAD ...

PLAINTIFF

AND

TAN SIEW CHOU ...

DEFENDANT

PEMBELAAN KEPADA TUNTUTAN BALAS

1. All the paragraphs of the Defendant's statement of defence are

disputed.

2. Section 29(1) and (2) of the Inland Revenue Board of Malaysia

Act(Act 533) refers only to the board, not to its employees. This statement of

claim is against the employees of the board that has violated the Income Tax

Act as allowed by Section 118 of the Income Tax Act by acting in bad faith and

the Akta Pencegahan Rasuah 1997, Akta 575.

3. Section 21 of the Inland Revenue Board of Malaysia Act(Act 533) does

not protect employees who are not acting in good faith(“for anything which

is done in good faith”). The immunity against legal proceedings is conditional

on good faith.

4. Section 21 of the Inland Revenue Board of Malaysia Act(Act 533) must

be interpreted in full as demonstrated by the judgement “A taxing statute has

to be strictly construed and tax cannot be imposed unless there are clear and

unambiguous words which show an intention to tax a subject: Supreme court

National Land Finance Co-operative Society Ltd. v Director general of Inland

Revenue (1994) 1 MLJ 99”.

5. Section 136 of the Income Tax Act demands that authorization must be

in writing. There is no proof submitted or mentioned by the statement of

Defence of the Defendant that the Director General has approved penalties that

are against the Income Tax Act.

6. Section 118 of Income Tax Act does not exclude action against any

officer including the Director General himself if actions regarding the Income

Tax Act are committed not in good faith.

7. Section 99(1) of the income tax act clearly states that it is not

compulsory for the Plaintiff to appeal to the Special Commissioners as argued

by the defendant in paragraph 4 of the Statement of Defence. Standard of

interpretation of the Income Tax Act must comply with previous court cases as

shown by “Ketua Pengarah Hasil Dalam Negeri v Multipurpose Holdings Bhd. (2002)

1 MLJ 23, KC Vohrah J”.

8. The Plaintiff further argues that the defendant has acted in bad

faith in denying the Plaintiff his right to appeal to the Special Commissioners

despite many letters of objections. No forms were offered for the Plaintiff to

fill in.

9. By misinterpreting the income tax act the way the defendant did in

paragraph 4 of the Statement of Defence, bad faith is further proven. This is

despite the clear directions set by Malaysian courts of law in interpreting the

Income Tax Act so as not to penalise tax payers unnecessarily.

10.

Section 106(3) of the Income Tax Act, only

refers to suits initiated by the Government to recover taxes. The Plaintiff is

currently paying all taxes due including penalties that are disputed. There is

no need for the Government to initiate any recovery suit.

11.

Section 106 clearly shows the need for tax

payers to initiate complaints and any court actions to dispute any tax or

penalties. Otherwise there is no other avenue to rectify other misuses of

powers by the employees of LHDN. The Small claim court is certainly the right

court for tax payers to turn to when the amounts of losses incurred by

government officers who do not act in good faith in interpreting and executing

any statue law. This is contrary to the argument put forward in paragraph 4 and

5 of the Statement of Defence.

12.

Section 21(1) of the Government Proceedings Act

1956, must be interpreted with relevance to the case in hand where the Income

Tax Act, in section 118, and section 21 of the Inland Revenue Board of Malaysia

Act(Act 533), overrides that act. The Plaintiff has no need to take action

against the Government of Malaysia because this case is due to the illegality

and negligence of Government Officers and section 118 reinforces that actions

can be taken against government officers not acting in good faith in executing

the Income Tax Act. There must be reasons why Malaysian Parliament introduces

the phrases “in good faith” in many of the sections of the Income Tax Act, as

preconditions to immunity from prosecution, as argued in paragraph 3 and 4

here.

13.

The Plaintiff can show with proofs that the

Defendant are not acting within the Income Tax Act as shown in my Additional

Arguments In Support of the Statement of Small Claim. Paragraph 7 of the

Statement of Defence is just false declaration.

14.

Paragraph 8 of the Statement of Defence is a

gross misinterpretation of the Income Tax Act by substituting the word “may”

with “have to”. Refer to paragraph 7, 8 and 9.

15.

Paragraph 9 of the Statement of Defence is again

a gross misinterpreting of the Income Tax Act. Refer to paragraph 3 of the

Additional Arguments In Support of the Statement of Small Claim. The imposition

of any penalty is only allowed if no payment were made. Clearly the request by

the Plaintiff and approval of payment by instalments proved that taxes have

already been paid as defined by the Income Tax Act itself in section 103(7)

reinforced by section 108(14) of the Income Tax Act.

16.

Paragraph 9 of the Statement of Defence

sinisterly imply that notices of assessments are the same as notices for

penalties. This is not supported by any law at all. Since there are no

references to the Income Tax Act, this argument must be rejected based on the

standard of interpretation of the case: “A taxing statute has to be strictly

construed and tax cannot be imposed unless there are clear and unambiguous

words which show an intention to tax a subject: Supreme court National Land

Finance Co-operative Society Ltd. v Director general of Inland Revenue (1994) 1

MLJ 99”. Penalties are complete different from assessments. Not many people are

authorised to award penalties. When awarding penalties, there must be

sufficient safeguards and notices

17.

As proven by paragraph 9, of the Statement of

Defence, there are no notices of penalties when they were imposed. Notices of

penalties are vital for complex cases such as the payment of income taxes. The

only statements that the Plaintiff had received keep on showing surplus

payments. These statements are more reliable than the statements mentioned in

paragraph 9 of the Statement of Defence. These are transaction statements where

assessments and payments are clearly stated in full details. In fact the said

“statements of assessments” are just statements of assessments, without any

mention of payments. Failure to provide complete statements where assessments

are weighed against payments, before any penalty is finalised, as demanded by

Section 103(3) and common law of natural justice, is clear proof of acting not

in good faith in executing the Income Tax Act and therefore illegal.

18.

Paragraph 10 of the Statement of Defence is not

the issue raised by the Plaintiff, rather evidence that payments have already

been made. It proves that the Defendant has the authority to collect payment at

any moment. The moment the Defendant has the ability to collect payment,

section 103(3) no longer authorises any officer under the Income Tax Act to

impose penalties.

19.

There is clear proof that penalties were still

imposed, despite official statements prepared by the Defendant clearly showing

penalties being imposed despite excess payments being made by the Plaintiff.

The statement in Argument E/4, paragraph 2 of The Statement of Claim is only

denied but not challenged by the Defendant. This is clear proof that the

penalties were made not in good faith. The rights and privileges conferred by

law are only conditional that they be carried out in good faith.

20.

Evidences that will be easily shown, proves

that actions were taken not in good faith. Even in the Statement of Defence,

misinterpretions of the Income Tax Act exist, as had already been shown in

earlier paragraphs , which provide even more evidences of lack of good faith of

the Defendant. These make a mockery of paragraphs 12 and 13 of the Statement of

Defence.

21.

The court should take note that the Defendant

agree in paragraph 14 of the Statement of Defence, that the excess payments are

not interests, but penalties. Therefore the court must agree that conditions

when imposing penalties must be adhered to in order that justice be carried out

in full.

22.

Paragraph 15 again provides clear evidence that

tax has already been paid via instalments and Section 103 (7) of the Income

Tax Act allows payments of any outstanding taxes via instalments. Therefore

there is no need to impose any penalty any more according to the act. The

Defendant has chosen to ignore this fact and still impose penalties thereby

causing losses to the Plaintiff. The government and the act cannot be faulted,

only the officers who are acting not in good faith and therefore the Defendant

is denied the right and protection under the Income Tax Act and Inland Revenue

Board of Malaysia Act(Act 533) .

23.

Paragraph 16 of the Statement of Defence shows

clearly that the Plaintiff is acting in good faith in trying to pay taxes. The

Plaintiff denies that there has ever been any objections to payment of old

taxes. Only penalties that were imposed on taxes that had already been paid.

Imposing penalties on taxes that had already been paid or considered to be

fully paid by virtue of the Plaintiff's agreements and requests for payment

via instalments.

24.

The Plaintiff's willingness to pay via

instalments, admitted by the Defendant, is not interpreted as a good faith in

attempting to pay any tax as indicated by the Defendant in Paragraph 17. This

is further proof that the Defendant is not acting in good faith in dealing

with the Plaintiff.

25.

Paragraph 18 is claimed without any reference

to any section of any act relevant to this case. The Plaintiff has proof that

the practise of making PCB deductions only for “the relevant current year only”

is against the law. Firstly, there is no such phrase in the act. In fact, the

only available section is in the Income Tax (Deduction From Remuneration)

Rules, Rule 10 (1), the phrase “total amount of tax deducted” shows clearly

that those salary deductions are taxes that are being paid. Since there is no

additional words such as current year, the deduction must be interpreted as

what it should be if natural justice is to be preserved, that is, it is the

payment of any tax, not future taxes, because future estimates are not taxes

yet.

26.

By using common sense, guided by the Income Tax

Act, it should be clear that taxes are only incurred once they are properly

assessed. The assessments are not made at the current year. For example, the

assessments for the current year 2006, were only made on the 30th of

April, 2007. The deductions of salaries under the Income Tax (Deduction From

Remuneration) Rules, Rule 10 (1) are provided for citizens to pay taxes. If

there are no tax, payable, the money should be automatically be used to pay any

tax that may appear, as stipulated by the Income Tax Act. If none, it can be

used as reserve.

27.

Paragraphs 20 to 25 have already been argued in

previous paragraphs here.

28.

None of the paragraphs in the Statement of

Defence have shown any remorse or complete defence against all allegations. The

Defendant has not bothered to defend why there are discrepancies in the figures

in the Co23 documents with the Computerised Transaction documents which are the

most important point for the Plaintiff in proving that the Defendant is acting

not in good faith. In fact it is illegal to falsify official documents. By not

defending against an illegal act, it shows that the Defendant is guilty as

charged.

29.

All the statements of defences in the Statement

of Defence have been shown to be false. In fact, they provide further evidences

to prove beyond reasonable doubt that the Defendant is acting not in good faith

in imposing penalties because taxes have already been paid as acknowledged by

the Income Tax Act through instalments.

30.

Furthermore, there is no defence offered against

the discrepancies between the official statements i.e. the Co23 documents(acting

as invoices) versus the actual computerised transaction records(acting as

receipts). Even the Director General of Inland Revenue admitted in newspapers

that LHDN has problems with record keeping. The Defendant's failure to double

check any of the Plaintiff's consistent objections and calculations, shows that

the Defendant is acting not in good faith and therefore does not deserve to be

protected. The acts relevant to this case, mentioned previously clearly shows

that immunity can only be granted with conditions that actions be made in good

faith.

31.

The claim by that the Defendant is only acting

on the instructions of higher authorities must be dismissed because there is no

single evidence or argument offered. Ignorance is not a defence.

32.

The violations of the Statute Laws by the

Defendant give ground for the Small Claim by the Plaintiff as supported by the

“Akta Tafsiran(Akta 388)”, section 58 and 121, where it is stated that

“pengenaan penalti tidak menghalang kepada tindakan sivil”

33.

“Akta Tafsiran(Akta 388)”, section 62A, allows

the admission of electronic media as evidence provided the data can be

verified. The Defendant has failed to challenge the source of evidence as

stated in the Statement of Claim by the Plaintiff in Paragraph 3.

34.

“Akta Tafsiran(Akta 388)”, section 13 shows that

Statue Laws are public unless they are clearly stated. The Plaintiff can use

relevant acts in getting judgement of claims against damages.

35.

In “Akta Pencegahan Rasuah(Akta 575)”, section

2,”Tafsiran, “suapan” ertinya – (d) apa-apa jenis balasan berharga , apa-apa

diskaun, komisen, rebat, bonus, potongan atau peratusan”. Since the employer of

the Defendant, gives out bonuses and other valuable incentives for success in

collecting taxes, this can be regarded as corruption, when the taxes are

collected illegally.

36.

In “Akta Pencegahan Rasuah(Akta 575)”, section

12, “Penerimaan atau pemberi suapan adalah bersalah walaupun maksud tidak

terlaksana atau perkara tidak ada hubungan dengan hal-ehwal atau perniagaan

prinsipal”, which supports the corruption charge despite the uncertainly of

getting bonuses or other financial incentives from the employer of the

Defendant, i.e. LHDN.

37.

In “Akta Pencegahan Rasuah(Akta 575)”, section

15 (1) “Mana-mana pegawai badan awam yang menggunakan jawatan atau kedudukan

untuk mendapat apa-apa suapan adalah melalukan suatu kesalahan”, frofm the

Statement of Defence, the Defendant of being treated as a government servant so

is bound by this act if it is proven that the Defendant has misused any

authority. No monetary exchange need to occur as had been proven by the

corruption charge against Anwar Ibrahim versus the Malaysian Government.

38.

In “Akta Pencegahan Rasuah(Akta 575)”, section

15 (2) “.mengenai pegawai itu, atau mana-mana saudara atau sekutunya, mempunyai

kepentingan, sama ada secara langsung atau tidak langsung”. This section gives

the burden of proof to the Defendant. In secion 2, “sekutu bererti – (c)

mana-mana firma yang orang itu, atau mana-mana penamanya, menjadi pekongsinya

atau”. The employer of the Defendant, LHDN, can be considered as its partner

because of the way the emoluments were given out. Failure of the Defendant to

challenge Paragraph 3 and 4 of the Statement of Small Claim, makes the

Defendant guilty as charged because there is not sufficient proof given that

the Defendant is not guilty as charged in the Statement of Small Claim.

Ignorance that these are not within the jurisdictiion of Act 575, cannot be

used as a defence.

39.

In “Akta Pencegahan Rasuah(Akta 575)”, section

19 , “Pembuatan pernyataan yang palsu atau mengelirukan, dsb. kepada pegawai

Badan atau Pendakwa Raya, (3) “Bagi mengelakkan keraguan, adalah diisytiharkan

bahawa maksud perenggan (1)b dan subseksyen (2), apa-apa pernyataan yang

dibuat dalam apa-apa prosiding undang-undang di hadapan mana-mana mahkamah,

...”. In this case, the Statement of Defence is the statement which is

relevant. By not adequately defending against the discrepancies in the Co23

document produced by the Defendant, against computerised transaction records,

the Defendant is guilty of making a false or confusing statement, in the Small

Claims court.

40.

In “Akta Pencegahan Rasuah(Akta 575)”, section

42, reinforces that for charges according to section 15 of Act 575, the burden

of proof lies on the Defendant.

41.

In “Akta Pencegahan Rasuah(Akta 575)”, section

45. “Kebolehterimaan pernyataan orang tertuduh”(4), “... tidaklah menjadi

tidak boleh diterima keterangan semata-mata kerana tiada notis sedemikian

disampaikan kepada orang itu jika notis sedemikian disampaikan padanya dengan

seberapa segera yang semunasabahnya mungkin selepas itu.” The statements made

by the Defendant in the statement of Defence is acceptable despite failure to

provide earlier notice because this current statement can be considered as

such a notice.

42.

In “Akta Pencegahan Rasuah(Akta 575)”, section

45(7) “Tiada apa-apa jua dalam sub seksyen (6) boleh, dalam mana-mana prosiding

jenayah- (a) menjejaskan kebolehterimaan sebagai keterangan perbuatan berdiam

diri atau apa-apa reaksi lain tertuduh semasa apa-apa jua”. This section

supports the impositing of judgement although the Defendant has been silent on

the accusations provided in Paragraph 3 and 4 of the Statement of Small Claim.

43.

In “Akta Pencegahan Rasuah(Akta 575)”, section

49, “Keterangan tentang kelaziman tidak boleh diterima”. The Defendant cannot

claim that the practise of ignoring the discrepancies in the Co23 statements

prepared by the Defendant is a usual practise of the LHDN, is a defence.

44.

In “Akta Pencegahan Rasuah(Akta 575)”, section

50 is irrelevant because this is only a claim of damages as a result of

non-compliance with Act 575. No intention to prosecute the Defendant under the

full legal force of Act 575.

45.

In “Akta Pencegahan Rasuah(Akta 575)”, section

56, “mana-mana pegawai lain yang mempunyai kuasa untuk menyiasat, mendakwa

atgau mengambil apa-apa prosiding berkenaan dengan kesalahan ini”. This gives

the Small Claims Court magistrate to use the provisions of this act in order to

award damages against the Defendant for breaking Act 575.

46.

In “Akta Pencegahan Rasuah(Akta 575)”, section

57, “Mana-mana orang yang tidak mematuhi mana-mana peruntukan Akta ini atau

......., adalah melakukan suatu kesalahan. The Defendant is deemed to be

breaking the law by not complying with Act 575.

47.

The Defendant's failure to act in good faith in

executing the Income Tax Act, and violations of the both the Income Tax Act and

“Akta Pencegahan Rasuah(Akta 575)” resulted in losses that the Plaintiff seeks

to address. The amount stated in the small claims plus costs are therefore

claimed by the Plaintiff.